Renewable energies are having a record year in 2020, and green electricity is in demand as never before. Institutional investors in particular are getting on board. "From a risk perspective, investments in renewable energies have become increasingly attractive", says Markus W. Voigt, CEO of aream Group. "That's because the more plants that are on the grid, the more a portfolio can be diversified and fluctuations are smoothed out."

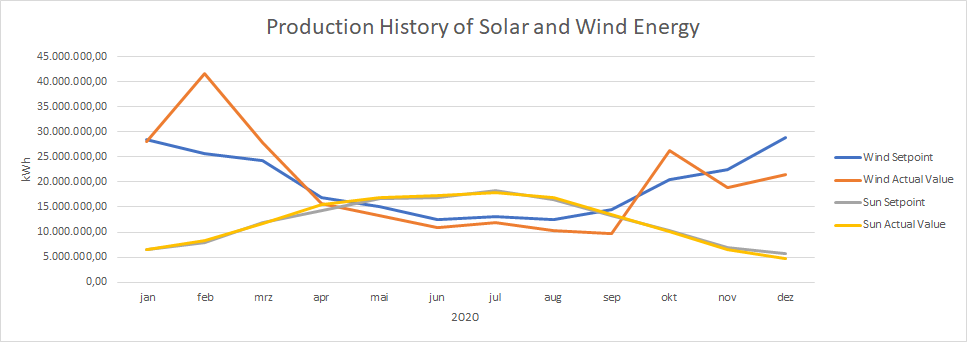

The figures support this: in 2020, wind farms overdelivered by around 1.5 percent compared to the target, and photovoltaic farms were at a target achievement rate of 100 percent. Over the course of the year, however, some of this looked quite different. "In February, wind output was so significantly above target that the slight minus in the summer months was fully compensated for", said Voigt. "A strong October then provided enough of a buffer to offset the unexpectedly low wind months of November and December and come out of the year with an overall 1.5 percent gain."

For photovoltaics in 2020, the target and actual values were not quite as far apart over the course of the year. "On the other hand, greater regional fluctuations were evident here", says Voigt. In Italy, for example, around three percent more electricity was generated from solar than planned, while in Spain the result was almost five percent below expectations. "In Germany, the target was achieved exactly".

"All in all, solar radiation can be predicted relatively well, while wind is very volatile - but over the course of the year, the two balance each other out", says Voigt.

"Socially, the growth of renewable energies is a win-win in any case", says Voigt. But it's also clear that further growth also requires further investments. "And these are becoming increasingly attractive, especially in terms of risk", notes Voigt. A few years ago, for example, investing in just one wind farm or solar parl meant a major cluster risk. Now, portfolios can be built that are highly diversified in terms of both energy type and region. "A weak solar year in Spain is then compensated for by a strong one in Italy, weak wind in eastern Germany by a higher wind yield for parks in NRW, for example."

What's more, in addition to traditional investments in wind or solar plants, other areas of a developing cleantech industry are becoming increasingly attractive. "This starts with energy sources such as biogas or hydrogen and extends to the many small start-ups in the field that provide services related to renewable energies", Voigt explains. "Some of these are already on the stock market, others can be invested in through specialized funds.

PRESSEKONTAKT:

Leandra Kiebach

T: +49 (0)211 30 20 60 4-2

E: lk@aream.de